|

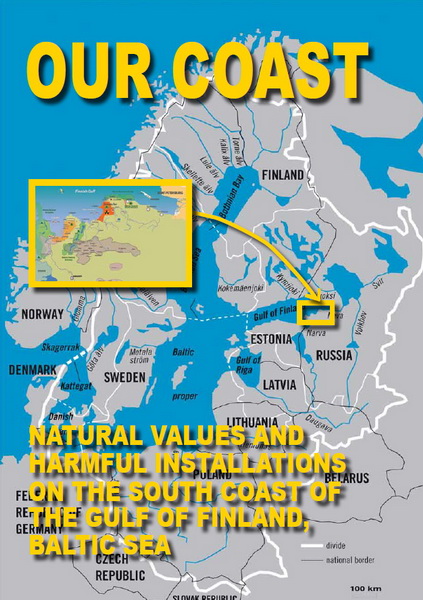

The South Coast of the Gulf of Finland |

|---|---|

| Natural Values and Harmful Installations |

|

Concept of a decommission plan for old nuclear power reactors |

|---|---|

| Guiding Principles from Environmental NGOs |

4. Risks of nuclear scenario

Below there are additional risks that should be considered in the process

of decision-making to develop nuclear generation in the Republic of Belarus.

4.1. Risks of Accidents

In opinion of the experts speaking in favour of construction of the nuclear power plant in RB, modern nuclear power plant design of new (third) generation have much smaller risk of leak of radioactivity outside the reactor unit – 10-7-8 per reactor per annum. For comparison the risk of accidents with radioactivity leaking outside reactor unit for the Chernobyl type reactors is evaluated 10-3-4 per reactor per annum.

There is an opinion in nuclear branch that tank-type reactors cannot blow up by definition as they possess natural safety: disappearance of decelerator as a result of reactor zone overheating leads to discontinuation of nuclear reaction. However, under certain conditions thermal explosion of tank-type reactors is possible. As an example it is possi-ble to refer to the accident at submarine in the Chazhma bay in 1985, where explosion has occurred exactly on tank-type reactor.

The fact about risk of large-scale accident at modern nuclear power plant is pre-sent and it is high enough is confirmed by plans of Rosatom, which is not going to build nuclear power plants in immediate proximity Moscow and Saint-Petersburg in spite of the fact that these cities experience the sharpest shortage of capacities possessing, at the same time, a necessary infrastructure, professional staff and so forth.

A similar situation has taken shape in the Republic of Belarus as well. It is decided to abandon a civil-engineering project of building a NPP near capital of the republic, though nearness of Minsk and presence of LEP-750 transmission line, passing close to Minsk creates favorable technological and economic preconditions for construction of nuclear power plant near Minsk.

The official recognition of danger of NPP is noted in the State Comprehensive Program of Modernization of Main Production Assets of the Belarusian energy system, energy efficiency and increase in share of use in the republic of own fuel and energy re-sources in 2006-2010 according to which admits that NPP is an object with increased po-tential danger to environment.

Risks of large accident resulting from plane crash. Power generating unit VVER-1000 proposed for construction has a protective coat, capable to sustain impact of crashed sport plane weighting 20 tons, however, passenger planes with fuel onboard can weight ten times more. Here it is necessary to note that no country of the world can boast having 100% guarantee of protection against attack on NPP, using an aircraft.

The risks of large accident connected with poor quality of construction. The Russian nuclear engineering experiences sharp shortage of professional builders. Out of 55,000 builders needed today Rosatom has only 5,000 professional builders. Low appeal of nuclear branch is connected, inter alia, with low wage of builders. For example, at construction of the second unit of the Volgodonskaya NPP in the Rostov region a profes-sional builder receives RUR 6,300 a month (data as of early 2006) As a result construc-tion involves labor with poor skills. For example, the labor involved in construction of fast neutrons reactor BN-800 at the Beloyarskaya NPP in Sverdlovsk region is poor skilled workers from Tajikistan and Azerbaijan. According to 2003 data, none of workers was subjected to security check. Statistics evidences about quality of this labor: after commencement of works the number of murders and robberies in the city of Zarechny (the city serving the Beloyarskaya NPP) has increased 5-6 times. In the NPP territory thefts of nonferrous metal have sharply increased.

The risks of accidents connected with power supply system failures. Failures in power supply system lead to risks connected with the fact that switching of station to an independent mode (diesel engine-generators) may not work. In 1992 a hurricane resulted in disconnecting the Kola NPP. Emergency diesel engine-generators have not provided prompt supply energy to stop reactor.

The risks of accidents connected with long period of operation. Design of new nuclear power plants envisages operation of power units during 60 years. Such policy starts covering the running reactors, designed for 30-year operation. However, experience of extension, for example, of the third unit at Novovoronezhskaya nuclear power plant shows that after 30 years in operation susceptibility of breakdown increases. The third power unit has been commissioned in December 1971. After expiry of the term of operation (30 years), functioning of the third unit at Novovoronezhskaya nuclear power plant has been extended for 5 years. Upon termination of validity of the first extension license, Rostekhnadzor has issued one more. In 2007 Rostekhnadzor has found cracks in welded connections of branch pipes of “hot” and “cold” collectors of the first steam and gas gen-erator of the Novovoronezhskaya nuclear power plant third unit. This incident only con-firms the point of view about dangers of long – up to 40-60 years – period of operation of nuclear power units.

The risks of accidents connected with social and economic crises. In case of so-cial and economic crisis as it has happened in mid 90-ies in Russia, nuclear power plants are exposed to threat of accidents because of social protests. In the Russian atomic engi-neering history there are examples when workers of the nuclear power plant occupied nu-clear station, raising economic demands.

Risks of accidents connected with military actions. The concept of safety of the existing nuclear power plants till now has been assuming their operation only in peace time. Meanwhile, majority of the European nuclear power plants are located in territory, where in the twentieth century operations with application of heavy weapons were re-peatedly conducted. Hit of a single artillery shell, a rocket or an aerial bomb in any of buildings of the nuclear power plant will not lead to catastrophic consequences. How-ever, two exact hits would be enough for a nuclear power plant to launch an avalanche catastrophic process. So, if one shell damages and stops a turbo-generator, and the second shell puts out of order a reserve diesel engine-generating power station then circulation of water in the first contour will stop completely.

In passive cooling systems the stock of water is insufficient to ensure cooling of active reactor zone for adequately long time. Active systems of cooling cannot function without supply of electric power. In this case fusion of reactor active zone due to a resid-ual thermal emission and emission of radioactive substances outside the first contour is inevitable.

If buildings of the nuclear power plant are subjected to series of aimed shots, breaking through protective environment of the reactor building, the emission of radioac-tive substances into atmosphere and contamination of large territory is inevitable. A unit of fire of one tank or the attack plane is enough for utter annihilation of nuclear power plant as power object and contamination of large territory. Conventional weapon applied against a nuclear power plant, becomes weapons of mass destruction .

As well, the scenario of using heavy weaponry in peace time should not be rejected. For example, the scenario of terrorist attack using a mobile howitzer system, which can be placed several kilometers away from the nuclear power plant outside physi-cal protection perimeter of the plant.

The risks connected with transportation and storage of radioactive waste and depleted nuclear fuel. In addition to risks, related to operation of nuclear power plant there are plenty of risks connected with transportation and storage of radioactive waste and depleted nuclear fuel. The issue of storage of radioactive waste has not been studied completely till now, as periods of storage exceed, at least, hundreds years and for de-pleted nuclear fuel, ideally – hundreds of thousand years. Here it is necessary to note that already today there are problems of leakage of radioactive nuclides outside storages areas in France and Germany after some decades of storage of radioactive waste.

4.2. Investment Risks, Related to Cost and Period of Construction of NPP

The risks connected with initially high cost of new power units. In Russia cost of construction of nuclear power plant is considerably takes the lead over inflation. During 7 years official specific cost of capital investment has grown almost 3 times – from RUR 20.2 bn. in 2000 to RUR 55.7 bn. in 2007 [5, 6]. This tendency corresponds to global processes. According to report, prepared by Cambridge Energy Research Associates Inc., the cost of materials for construction of the nuclear power plants have grown by 173 % from 2000 to early 2008, whereas for wind energy generation similar growth was 108%, for coal 78% and gas 92%.

Initially high cost of nuclear power units finds its reflection in tariffs of nuclear stations. Approximately 20% of the Russian nuclear engineering proceeds (in 2007 RUR 15 bn.) goes to construction of new power units and other infrastructure. In conditions of the set tariff level in the wholesale market (approximately US$ 0.02 per kWh) this is ob-viously not enough for construction of new nuclear power plants. The investment poten-tial of internal resources Rosatom at all does not satisfy plans of the government, aimed at accelerated development of nuclear engineering – construction of 2 power units per annum that demands circa RUR 130 bn. per annum. Moreover, the nuclear power plant tariffs prevent execution of the program of simple replacement of decommissioned power units – 3.7 GW by 2020. Existing deductions are sufficient only for construction of one reactor in 3-4 years. To solve the problem an increase in tariff approximately 2.5 times from US$ 0.02 (in 2008) to US$ 0.05 per kWh is needed.

Therefore the Russian Government had accepted the Federal Target Program, aimed at development of nuclear complex, according to which it is supposed to subsidize construction of the new nuclear power plants from the federal budget. The size of subsidies on new construction amounts to circa RUR 670 bn. till 2015.

In this respect a potential investor needs to understand precisely that construction of nuclear power units is expensive. Payback of the investments will occupy the longest period if at all it would be possible, especially in the countries with regulated energy market.

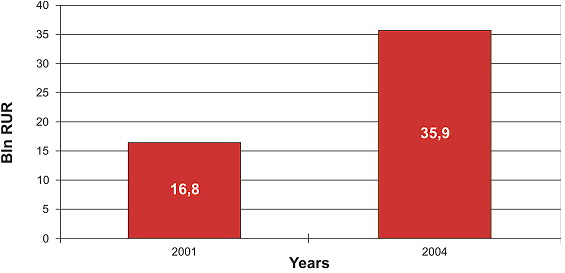

The risks connected with growth of cost during construction. Experience of completion of third unit at Kalininskaya nuclear power plant has shown that cost of 50 % completion of object has appeared comparable with design cost of 100 % construction from zero. Cost of completion of Kalininskaya nuclear power plant appeared as follows. According to Chamber of Accounts, the rest of budget cost of construction on launching complex of construction of power unit 3 of Kalininskaya nuclear power plant taking into account objects of social sphere as of 1 January 2001 amounted to RUR 8.2 bn. or 48.7% of capital investments. However, according to official data, only in 2001-2004 RUR 23.2 bn. was allocated to complete this power unit. In late 2004 the power unit has been com-missioned, but, nevertheless, another RUR 4.1 bn. was allocated for its operational de-velopment in 2005. As a result total cost of power unit amounted to RUR 35.9 bn. instead of the declared RUR 16.8 bn. or more than in 2 times exceeded the declared cost. Cost of completion that is more correct to evaluate growth of cost of construction, reached RUR 27.3 bn. and more than 3 times has exceeded the declared cost. Even with inflation taken into account such excess is significant.

Similar situation is taking shape with construction of nuclear power units in Finland and France. Cost of reactor in Finland (1,600 MW) has grown during construc-tion from contractual €3.2 bn. to €4.7 bn., at the same time the project is far from end. The declared cost of Flamanville reactor has grown by 20% from €3.3 to €4 bn. It has led to the company increasing the predicted cost of the sold electric power from €0.046 to €0.054 per kWh.

Growth of cost during construction is the major factor in evaluating payback and profitability of nuclear projects. So, analysis of sensitivity of the project “to increase in volume of capital investments into construction of the nuclear power plant” (2 power units VVER-1000) is prepared for the second stage of the Balakovskaya NPP. Analysis, executed by authors of the Balakovskaya NPP project has shown that the project has a net discounted income equal to zero with increase in volume of capital investments into in-dustrial construction by 60% [14]. In case of construction, for example, of the third unit of the Kalininskaya NPP the excess was 110%.

Figure 19 - Growth of cost of construction of third power unit of the Kalininskaya NPP (RUR bn.)

Figure 19 - Growth of cost of construction of third power unit of the Kalininskaya NPP (RUR bn.)

The risks connected with increase of period of construction of nuclear power plant. Period of construction of one nuclear power unit lasts 5-7 years unlike other energy sectors, for example, wind energy where hundred megawatt capacity wind energy generating plants can be built within 1-2 years.

At the same time the declared periods, as a rule, are not maintained. The delay in construction of the nuclear power plant in Finland is three years after 3 years from its commencement. Thus, every year of construction means a one year delay. Initially it was planned to build a reactor in 4 years, now it turned to be 7 years. Similar problems have emerged at construction of the power unit in France.

One of the preconditions to long-term construction in the Russian nuclear complex is shortage of professional builders. According to Rosatom plans, the number of profes-sional builders should grow from 5,000 in 2006 to 55,000 by 2009 which is very unlikely.

4.3. Risks, Related to Fuel Supply

For today the unique large operating uranium deposit in Russia provides only 16-18% of the required needs for natural uranium – 3,200 tons per annum out of almost 20,000 tons of natural uranium needed (with supply to foreign nuclear plants). The “TVEL” company, responsible for fuel supply of the Russian and foreign nuclear plants, gets the difference, which is missing fuel, from “warehouse stocks”. Thus, there is a sub-sidizing of nuclear engineering due to even uranium stocks, accumulated in Soviet times, mainly as a result of implementation of military programs.

![Figure 20 - Structure of coverage of needs in raw materials of the branch till 2020 [15] Figure 20 - Structure of coverage of needs in raw materials of the branch till 2020 [15]](http://greenworld.org.ru/sites/default/greenfiles/images/fig20.jpg) Figure 20 - Structure of coverage of needs in raw materials of the branch till 2020 [15]

Figure 20 - Structure of coverage of needs in raw materials of the branch till 2020 [15]

According to Rosatom data, stocks in storage covering needs in uranium by 30% will be exhausted by 2015 – the period of scheduled commissioning of the first nuclear power unit in Belarus. It is assumed that this source of uranium will be compensated due to opening new mines. The question of opening of new deposits in the declared volume is de-batable. Besides circa 20-25% of needs in uranium now becomes covered due to import of the depleted uranium from Western Europe (See Fig. 20 item “Import of Uranium and Raw Materials from Countries other than CIS”). Contracts on import of this uranium should end in 2009. There exists a probability, that these contracts will be prolonged, as it is reflected in [15]. However, because of danger of storage of the depleted uranium, imported in the form of uranium hexafluoride, it is most likely that these contracts will not be extended.

Taking into account retirement of these two sources, shortage of uranium will reach circa 50% of the present consumption level. Based on plans of growth of consump-tion of uranium due to new contracts to supply fresh fuel including abroad the shortage can reach the order of 20,000 tons of uranium – circa half of the global production of natural uranium.

Till September 2008 Rosatom considered the Australian companies as a possible sup-plier of uranium. However, after events of August, 2008 in the Caucasus, as it is impossible to trace, whether Australian uranium will be enriched at the Russian military facilities , Special Commission of the Australian Parliament did not recommend the Government of Australia to conclude a new contract in the field of use of atomic energy with Russia, open-ing uranium stocks of Australia to the Russian companies. The situation with Australia shows, that the risks related with supply of nuclear fuel, are aggravated with problems in the international relations and the limited number of countries-suppliers of natural uranium.

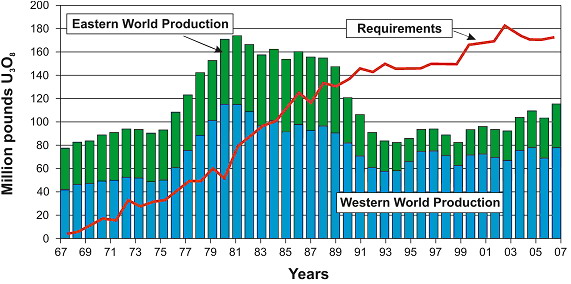

The situation in the Russian Federation is not unique. In 2005 the world production of uranium has reached circa 40 thousand tons with annual consumption of 69 thousand tons. Uranium shortage for the time being is covered by warehouse stocks and secondary sources. Based on IAEA forecasts by 2020 annual production of uranium will grow only to 65-70 thousand tons, whereas consumption would grow to 82-85 thousand tons.

Figure 21 - Global mining of uranium and the need in uranium

Figure 21 - Global mining of uranium and the need in uranium

As well, it is necessary to consider that now a significant part of nuclear fuel in the world market emerges due to dilution of the Russian weapon uranium. The uranium re-ceived from nuclear warheads covers 17% of the global market of enriched uranium. Af-ter 2014 when the contract on sale of the Russian weapon uranium (so-called contract VOU-NOU) will expire, it is necessary to expect a sharp decrease in offer on the ura-nium market and sharp growth of cost of nuclear fuel, possible in this respect.

4.4. Some Risks, Related to Unforeseen Growth of Maintenance Component of the Tariff

Growth of tariff in connection with shortage of uranium. Till now the Russian atomic engineering existed due to the Soviet stocks of uranium and operating mines, opened in the USSR. Opening and arrangement of new deposits demands significant fi-nancial resources. In this connection there is a probability, that partially these costs will be covered due to the tariff.

Growth of tariff with growth [of cost] of temporary storage services. According to [16], cost of storage of depleted nuclear fuel of the Russian nuclear power plants in the centralized federal storehouse until 2005-2006 was approximately US$ 60 per kg of heavy metal. Some estimates, which can be made, by referring to construction of the Balakovskaya NPP second stage, cost of temporary storage of depleted nuclear fuel from the Russian nuclear power plants has grown up to US$ 130 per kg of depleted nuclear fuel. Cost of storage of depleted nuclear fuel of the Ukrainian nuclear power plants has grown in 2009 in comparison with 2008 from US$ 360 to US$ 423 per kg of heavy metal. Therefore, no one can evaluate in the long-term prospective the real cost of stor-age, but it is clear that it only will grow, and grow considerably. The Rosatom representa-tives stated that “now people understand that it is impossible to calculate real cost of storage of fuel imported from abroad. We could accept it for 60 or 70 years, but what would happen in 100 years? In fact, nobody is able to count such costs” [17].

However, even in the short-term perspective the existing means are obviously not enough to ensure safe storage. For example, there is no appropriate system of physical protection of the centralized storehouse in the Krasnoyarsk region. In 2002 first Green Peace group of activists, and then FSB have freely entered the territory of storehouse and freely have left it.

Growth of tariff related to growth of cost of decommissioning of nuclear power units. Now tariff of nuclear power plants envisages deductions of 1.3% of the nuclear power plant proceeds for decommissioning of nuclear power units from operation. At the same time, according to S. Antipov, the “Rosenergoatom” Concern former General Di-rector “Shortage of means for decommissioning of power units has reached circa RUR 6 bn. in 2004, whereas by 2010 it may exceed RUR 8.5 bn.” [18].

It is important to consider that shortage 6 times exceeding annual deductions for decommissioning from operation, exists in a situation when the first 4 power units with aggregate capacity circa 1 GW are withdrawn from operation, whereas the deduction is made of the proceeds received as a result of operation of 23 GW capacities. In this con-nection “Rosenergoatom” Concern considers an issue of increasing deductions up to 2.3% [19].

4.5. Economic Risks, Related to Integration of NPP and Increase of Accidents in Power Supply Network

Construction of the nuclear power plant will lead in more than 50% of the electric power in the country generated by two plants – the nuclear power plant (2,000 MW) and the Lukomlskaya State District Power Plant (2,430 MW). Such concentration of capacity is fraught with large power interruptions in the system and heavy losses for economy. “Perfidy” of work in peak mode is in long-term influence on damageability and break-down susceptibility of units and their elements (boilers, turbines and generators) and amount of various repairs rather than in over expenditure of fuel in each cycle (i.e. in de-crease in blocks profitability). The majority of accidents at plants happen more often at start-up of units from “cold” condition – explosions of boilers, damages of turbo genera-tors’ shafts and breakage of turbine blades which sometimes lead to human victims. The damage from accidents is estimated in dozens and hundreds of million dollars.

4.6. Transboundary Risks of Nuclear Power Engineering Nuclear power plants in the Baltic Region

Construction of nuclear power plant in the Republic of Belarus is envisaged in wa-ter catchment basin of the Baltic Sea – environmentally vulnerable area, which has lim-ited water exchange with open part of the ocean. It means that in case of accidents at nuclear power plants, accompanied with discharge or dumping radioactive nuclides it would impact other countries and sea ecosystems around this semi-closed environmental space.

It is necessary to take into account that in the Western part of the Baltic Sea there takes place a process of decommissioning of nuclear power plants and ideas of new con-struction are abandoned [23].

Condition of power units

a) operational

b) planned

c) being decommissioned

d) run in excess of designed resource

e) planned export of nuclear power generated electricity

At the same time in the south and east of the Baltic Sea new project of nuclear power plants are being promoted. So, in the southern part political decisions have been taken to build at least 6 new power units for nuclear power plants a couple of hundreds of kilometers away from each within the nearest 15 years. It means that each separate solu-tion does not take into account aggregate or cumulative risk of all nuclear power plants for each country and for the Baltic Sea region in general.

It is known that risks related to functioning of nuclear power plants are the highest in the initial period of their operation and by the time when they are about to deplete their resource. Commissioning, within a number of years, of six power units in Belarus, Lithuania and Russia (Kaliningrad nuclear power plant) and si-multaneous decommissioning of the Ignalina nuclear power plant would result in highest probable emergency situations at NPP. However, these transnational risks have not been taken into account in the course of decision-taking to build a nuclear power plant.

4.7. Economic Risks, Related to Decommissioning of Power Plants

As a rule, all life cycle of nuclear power plant is not considered in the course of economic evaluation of nuclear engineering. Modern power units of nuclear power plant are planned by designers to generate electric power within approximately 50-60 years, the time, during which main elements of the equipment lose their properties, allowing their safe operation, and the “know-how” of energy generation becomes morally out-dated. From the moment of the termination of operation the nuclear power plant’s unit – the source of energy and income is transformed to the object consuming energy and re-sources.

Up to hundred thousand tons of the equipment and structures of such power unit become waste with significant part contaminated with radioactivity. It means that such object should be isolated reliably from habitat to prevent an opportunity of radioactive nuclides penetrating into biosphere and through food chains to humans. Besides it is nec-essary to exclude an opportunity of unauthorized access to this radioactive waste.

Concerning buildings and structures of the decommissioned nuclear power plants choosing one of the alternative strategies is possible:

- Immediate, stage-by-stage dismantling of the least polluted objects;

- The postponed dismantling in 50 and more years following decay of the signifi-cant part of radioactive nuclides.

In the course of decommissioning from operation a separate issue is recycling of depleted nuclear fuel, which is unloaded from reactor to the pools with cooled water, lo-cated next to reactor. Some years later fuel cores are moved to the pools of temporary storehouses cooled by the electric power. Then, in process of cooling cores, these are placed into special containers where depleted nuclear fuel continues to be cooled due to natural air circulation.

At present in the world there are no technologies of reprocessing of depleted nu-clear fuel that are safe for the nature and economically justified. Special danger of de-pleted nuclear fuel is caused by presence of radioactive nuclides there, which practically did not participate in millions of years of evolution of living systems on Earth. Among such radioactive nuclides, for example, is Plutonium (239Pu), which has half-life period exceeding 24,000 years. During life of the nuclear power unit from the beginning of operation prior to exhausting resource up to thousand tons of depleted nuclear fuel, contain-ing tons 239Pu is generated.

Depleted nuclear fuel should be isolated reliably from biosphere during hundreds thousand years. In the USA, following the Supreme Court’s decision reliability of isola-tion of the depleted fuel cores should be guaranteed for the period of 1 million years. At present there are no technological solutions, capable of solving this problem.

Modern data about cost of decommissioning power units from operation contain plenty of uncertainties, related to difference of decommissioning possible scenarios, na-tional policies of disposal of radioactive waste, depleted nuclear fuel, level of develop-ment of technologies in different countries, etc.

Table 9 - Costs of decommissioning of NPP units in different countries [23, 27]

| № | NPP, country | Type of reac-tor; capacity, MW | Cost, in US$ mln. | Notes |

|---|---|---|---|---|

| 1 | Big-Rock Point, USA | BWR, 70 | 25,0 | Upon unloading of depleted nuclear fuel the reactor body is removed. Total weight of radioactive waste was 290 tons. Storage of depleted nuclear fuel was left at the site – 43.3 ha. NPP used to occupy 182.2 ha. |

| 2 | Fort-Saint Vrain, USA | HTGR, 330 | 173,9 | Immediate dismantling option is adopted. Turned into gas turbine power plant |

| 3 | Maine Yankee | 900 | ~ 500 | Immediate dismantling to “green lawn” condition. Dry storage of depleted nuclear fuel is created close to the power plant’s territory. NPP territory after dismantling was reclaimed. |

| 4 | Tokai Mura, Japan | GCR, 166 | 772,5 | Dismantling started in 2001, would be over in 2017. 177,000 tons of radioactive waste is gener-ated in the course of dismantling, of which 18,000 tons are highly active. |

| 5 | Stade, Ger-many | PWR, 672 | 668,4 | First NPP, decommissioned after adopting the Law on closure of NPP. 150 of 300 persons left at the process of dismantling. |

| 6 | Biblis-A, Ger-many | PWR, 1225 | 141,2 | Evaluation of costs for full decommissioning of power unit. |

| 7 | Loviisa-1, Finland | VVER, 440 | 166,5 | Evaluation of costs for decommissioning to “brown lawn”. |

| 8 | Greifswald, Germany | VVER, 5×440 | 4 000 | Evaluation of costs for full decommissioning of 5 power units to the “Technopark” stage during 1990-2035. Up to one third of operations personnel is involved in decommissioning of former NPP. |

| 8 | Inganlina NPP, Lithuania | РБМК, 2×1500 | 1 500(3 300) | Evaluation of costs for full decommissioning of 2 power units to the “Technopark” stage. Activities of decommissioning started at 1 power unit. De-pleted nuclear fuel would be temporarily stored in “dry storage” containers. Costs of activities have more than doubled in some years after commence-ment. |

In a number of countries the state and maintaining organizations have made such evaluations. For example, the US Council on National Resource (NRC) and Nuclear En-ergy Agency (NEA) has estimated the cost of decommissioning from operation as 10 – 15% from cost of construction of object. [24]

Official French sources estimated €258.86 per kW of the installed capacity (data as of 1998). [25]

Estimation of cost of decommissioning from operation of the power unit with VVER-400 reactor, according to IAEA, can make US$ 350 mln. with immediate disman-tling and US$ 300 mln. in case dismantling is postponed by 40 years (US$ 795 and US$ 690 per kW of the installed capacity respectively). [26]

At the same time, practical experience of decommissioning from operation shows that the referred figures are essentially underestimated. So, in Germany expenses for de-commissioning of power units of the nuclear power plant with VVER-440 have more than 2 times exceeded the IAEA predicted. In the course of decommissioning from op-eration of 6 power units of nuclear power plant “Nord” costs would amount to €3.2 bn (US$ 4.4 bn.) or US$ 1,700 per KW. The “Nord” nuclear power plant will be decommis-sioned during 45 years from 1990 till 2035 to the condition of “brown lawn”, creating a technopark at the site of the former nuclear power plant. At the same time there will be unresolved problem of depleted nuclear fuel, which is in temporary (for 50 years) store-house. [23]

Originally Lithuania planned to spend €1.2 bn. for decommissioning from opera-tion of the two RBMK-1500 (2×1500 MWе electric power) power units during 30 years. This was evaluation of costs of decommissioning to condition of “brown lawn”, the or-ganization of depleted nuclear fuel temporary storage in metal concrete containers and organization of technopark. Later some years after commencement of the decommission-ing program this sum has increased to €2.5 bn. or US$ 1,100 per kW of the installed ca-pacity. In the future these expenses will undergo an increase as the technology of recy-cling of 3,400 tons of graphite (inhibitor of neutrons in RBMK reactors), carbon-14 containing radioactive isotope (with half-life period of 5,400 years) is not developed yet. By the way, the technology of long-term isolation or burial in the territory of Lithuania of the depleted nuclear fuel is not developed yet.

Expenses for decommissioning (Maine Yankee) 900 MW electric capacity power unit from operation to condition of “green lawn” reached circa US$ 500 mln., having ex-ceeded expenses for construction (US$ 340 mln.). At the same time, the depleted nuclear fuel is in temporary storehouse as technologies of long-term storage or burial of depleted nuclear fuel do not exist in the USA.

4.8. Social Risks, Related to Decommissioning of Power Plants

Construction of nuclear power plants in Central and Eastern Europe were accom-panied by creation of “atomgrads” – satellite cities of nuclear power plants, with popula-tion ranging from 30 to 70 thousand inhabitants. The nuclear power plant becomes a city factory. Social infrastructure and the budget of nuclear settlements completely depend on the nuclear power plant overall performance.

“Atomgrad’s” inhabitants, as a rule, do not have historical roots connecting them with local culture. It can become a source of social conflicts with inhabitants of the neighboring settlements, who perceive the nuclear power plant and “atomgrad’s inhabi-tants as threat to their traditional way of life.

The inevitable decommissioning from operation of the nuclear power plant after exhausting fuel resource causes serious social crisis connected with one-stage loss of the large number of highly paid jobs as well as main source of receipts of local budgets. [23]