|

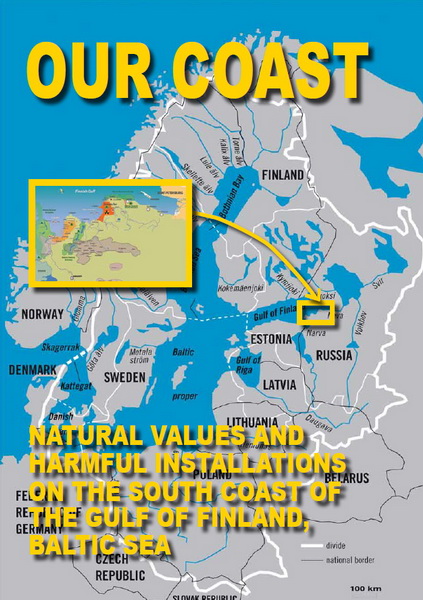

The South Coast of the Gulf of Finland |

|---|---|

| Natural Values and Harmful Installations |

|

Concept of a decommission plan for old nuclear power reactors |

|---|---|

| Guiding Principles from Environmental NGOs |

Executive Summary

In the nearest future the Republic of Belarus, like many other countries of the world will have to take a decision on how its energy sector is going to look like in the coming decades. Energy security and political status of countries would depend on deci-sions taken in this field.

Critical dependence on import of natural gas, which is becoming more and more expensive on 31 January 2008, pushed the Republic of Belarus National Security Council for taking a political decision to build a nuclear power plant.

A number of factors have not been taken into account in the course of taking this decision, which leads to doubts about correctness of the choice.

- Some input data, used for preparing a feasibility study to build a NPP contained errors:

- NPP capital construction unit costs, used in analysis and modeling – US$ 1,116 per kW – were definitely underestimated. In accordance with the Russian Federation Government figures, the cost of capital construction is almost 2 times higher and amounts to US$ 2,140 per kW (in 2007).

- The NPP feasibility study includes data of the International Nuclear Association, according to which cost of production of electric power, generated by NPP in France amounts to € 0.0254 and € 0.0393 per kWh. Figures of the Republic of Belarus National Academy of Sciences say that commissioning of a NPP into energy system of the repub-lic would provide for stabilizing cost of generation of electric power at the level of US$ 0.13/kWh between 2025 and 2030, whereas “gas-powered” option of development of energy system unit costs would rise to the level of US$ 0.18 per kWh in 2025 and US$ 0.21 per kWh in 2030. However, this is far from being the truth. In 2008 due to increasing costs of construction of the reactor in Flamanville (France) by 20% from € 3.3 to € 4 bn. estimated cost of generation of electric energy grew from € 0.046 to € 0.054 kWh. Evaluation of tenders for construction of NPP in Turkey the stated price of marketed electric power, generated by the Russian-design power generating units amounted to US$ 0.2079 per kWh.

- The decision was taken based on economic calculations, which, however, do not take into account some matters of principle:

- Experience of construction of nuclear power generating units in Russia proves that real costs are much higher than the initial ones. For example, real costs of construction of the third power generating unit of the Kalininskaya NPP (commissioned in 2004) turned to be more than 2 times higher than the envisaged. On top of this, based on calcu-lations of designers of the second stage of the Balakovskaya NPP, a more than 60% in-crease in volume of capital investments into construction makes erection of water-moderated water-cooled power reactors-1000 unprofitable.

- Growth of official costs per capital investments into nuclear generation consid-erably exceeds inflation indicators : within 7 years costs grew almost 3 times – from RUR 20.2 bn per GW in 2000 to RUR 55.7 bn per GW in 2007.

- Construction of NPP would require erection of non-nuclear capacities for additional non-nuclear hot reserve of 550 MW, which costs circa US$ 0.8 bn. and 1 GW pumped-hydrostorage plant to compensate poor flexibility of nuclear energy sector.

- The need to commission an additional hot reserve, based on natural gas, would result in decreasing NPP efficiency, from the point of view of saving gas, by 0.12 bn. m3.

- Since 2005, following the rise and fall in prices for uranium and oil the cost of uranium in relation to oil and gas saw a two-fold increase. Cost of conversion of uranium in the world market from 2004 grew by more than 40%, since 2005 cost of enriching in-creased by approximately 45%. In 2009 the cost of disposal of used nuclear fuel from Ukrainian NPP in Russia increased by circa 17%. All this evidently exceeds the forecast of 0.5% annual growth in cost of nuclear fuel, used in calculations.

- Reduction of energy consumption, which resulted from economic crisis, makes a decision to build an expensive NPP where the construction would take at least eight years, a quite risky one.

- Construction of NPP would lead only to partial solution of the problem of dependency on gas import. Nuclear generation would ensure replacement of approximately 4.35 bn. m3 of natural gas. Taking no account of natural gas, used as raw material (3 bn. m3) means that absolute reduction of the consumed natural gas would reach circa 23% by 2020 – a reduction of import of natural gas for energy sector from 18.5 bn. m3 to 14.1 bn. m3. Other es-timates say that the reduction would reach 3.51 bn. m3 or 20%. Taking into account natural gas, needed for additional hot reserve the reduction effect would be even lower.

- Construction, operation and decommissioning of NPP result in considerable economic and technological risks that should be considered separately.

- Choosing Russian-made water-moderated water-cooled power reactors-1000 as well, means choosing the uranium fuel supplier. None of the countries with NPPs, built by the Soviet Union was able to change nuclear fuel supplier, which is another proof of monopolistic dependency of Belarus from Russia.

Therefore construction of NPP could only partially solve the problem of replacing the imported gas, creating, at the same time, a lot of new problems, including those for the Republic of Belarus budget, because initially unprofitable nuclear fuel cycle would permanently require subsidies during decades. With presence of alternative less expensive and more secure ways of reducing consumption of natural gas, the nuclear scenario is the most expensive and risky.

Considerable reduction of import of natural gas in midterm perspective (20-30 years) would be possible due to modernization of gas energy sector of the Republic of Belarus and use of renewable sources of energy.

An alternative innovation scenario, proposed in the present note, provides for re-ducing consumption of natural gas in the energy sector by almost 50% from 18.5 bn. m3 to 9.3 bn. m3 with costs per unit of the saved natural gas by 20-40% lower than in the nuclear scenario.

Taking into account the above-mentioned it seems expedient, at least, to post-pone construction of NPP. As maximum, it is necessary to take a decision aimed at development in Belarus of energy sector using renewable sources – by 2020 based on biomass and use of wind potential and solar energy in perspective.