|

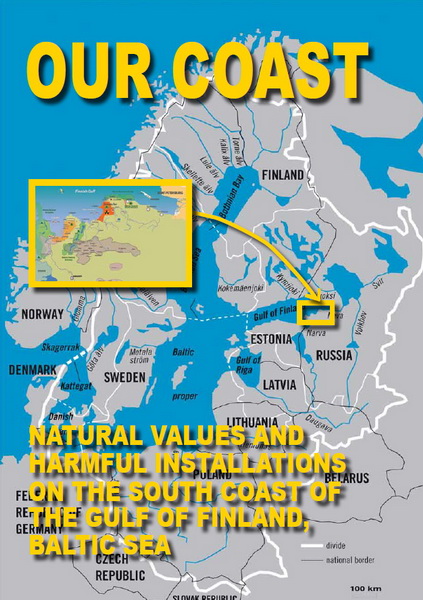

The South Coast of the Gulf of Finland |

|---|---|

| Natural Values and Harmful Installations |

|

Concept of a decommission plan for old nuclear power reactors |

|---|---|

| Guiding Principles from Environmental NGOs |

Siemens Seeks to Cash In on Russia's Atomic Adventure

Nuclear power is back in vogue in Russia, with 26 new reactors scheduled for construction by 2030. German industrial giant Siemens has grabbed a piece of the pie. But safety and financial concerns threaten to overshadow the country's atomic ambitions.

Olga Kurochkina can hardly hide her delight at making her German guests squirm. She has just served them caviar and pirogies and is now triumphantly waving a document in their faces. "Our students recently debated whether Germany needs nuclear energy," says Kurochkina, a teacher at an elite Moscow high school. "The arguments, of course, favor electricity from nuclear energy."

Kurochkina insists that there are "significant disadvantages" to all other energy sources. Wind turbines? "They produce infrasound, which causes depression." Solar cells? "They cause local cooling of the air."

It is hard to believe, but German energy policy is up for debate in Russian classrooms. The students at Kuochkina's school pay rapt attention to a multimedia show in which a virtual professor praises the electricity generated by nuclear power. At the end of the film, a growing orange tree appears on the screen, symbolizing the growth of the Russian nuclear industry. The message is clear: Things are going uphill fast.

Nuclear power is back in vogue in Russia, as if the meltdown at the Chernobyl nuclear power plant had never happened. The giant country has plans to build 26 new domestic reactors by 2030, and 20 more abroad

Major Nuclear Projects

In India and Bulgaria, Russian nuclear engineers are currently erecting turbine buildings and reactor shells, and there are plans to build more reactors in China, the Middle East, Southeast Asia and North Africa. Russia will even start the series production of floating nuclear power plants designed to desalinate seawater in remote corners of the earth.

The Russians are now confident enough to embark on major nuclear projects, and are doing so under the aegis of a company called Rosatom. Sergei Kiriyenko, the head of Rosatom and briefly a prime minister under former President Boris Yeltsin, is considered one of the country's most competent managers. This year alone, he has €3.4 billion ($4.6 billion) at his disposal for new nuclear power plants. He intends to invest about €35 billion ($47 billion) by 2015, of which the government will contribute 40 percent.

Russia's nuclear energy czar is backed by solid political support. Prime Minister Vladimir Putin, in particular, is an avowed proponent of nuclear energy. He has announced that 25 to 30 percent of Russia's electricity will be generated by nuclear power within 20 years. Today nuclear power satisfies 16 percent of the country's electricity needs.

Kiriyenko scored his biggest coup to date in March, when he and Peter Löscher, the CEO of German electronics giant Siemens, agreed to enter into a "strategic partnership." The two companies envision the construction of a nuclear power plant in the Russian enclave of Kaliningrad as their first joint project.

The duo believes that there will be demand for about 400 nuclear power plants worldwide by 2030. "We want to be the global market leader," says Kiriyenko, "and one third of the market is a respectable target." Löscher anticipates "a market potential of €1 trillion ($1.35 trillion)" and "close cooperation for many years."

Siemens Market

Siemens is hoping for a big part of the Russian nuclear renaissance. Here, the head of the Federal Atomic Energy Agency Sergei Kiriyenko with Siemens CEO Peter Löscher Both sides have high expectations of the deal. Rosatom wants to benefit from German know-how in the fields of control technology, steam turbines and generators, and has high hopes for the "psychological" effect of the joint venture, as Kiriyenko calls it. In other words, nuclear power plants with a German seal of quality are more marketable. The Russians also hope to enter new markets. "Latin America, for example, is a traditional Siemens market," says Kiriyenko.

Siemens is hoping for a big part of the Russian nuclear renaissance. Here, the head of the Federal Atomic Energy Agency Sergei Kiriyenko with Siemens CEO Peter Löscher Both sides have high expectations of the deal. Rosatom wants to benefit from German know-how in the fields of control technology, steam turbines and generators, and has high hopes for the "psychological" effect of the joint venture, as Kiriyenko calls it. In other words, nuclear power plants with a German seal of quality are more marketable. The Russians also hope to enter new markets. "Latin America, for example, is a traditional Siemens market," says Kiriyenko.

Siemens, for its part, which only recently ended a hapless joint venture with the French nuclear power company Areva, wants the Russians to help it quickly find its way back into the nuclear power business, an attractive field once again. Besides, an alliance with Rosatom would provide Siemens customers with reliable access to fuel rods for decades. Russia has more than 40 percent of worldwide uranium enrichment capacity.

But will it really work out for the Germans? The partnership is already stalling before it has even begun. In March, Löscher announced that the objective was to sign the final contracts by the end of May. Now officials at Siemens are saying that the contracts will most definitely be signed by the end of the fiscal year in September. The difficult negotiations over parting ways with Areva are said to be the main reason behind the delay.

On the other hand, the Soviet nuclear legacy could also get in the way of the partnership. Rosatom is struggling with various problems, including unresolved disposal issues, staffing shortages and countless breakdowns and accidents. More than a third of the country's 31 nuclear power plants are more than 30 years old.

The many contradictions in the Russian nuclear industry are in evidence in Sosnovy Bor, on the Gulf of Finland about 80 kilometers (50 miles) west of St. Petersburg. The road to the city passes through thin pine and birch forests, past sandy hollows and rustic wooden dachas, under a bright blue sky, to Koporskaya Bay.

Earthquake Proof

A special permit is required to pass through a checkpoint on the outskirts of the city. Sosnovy Bor, with its 68,000 inhabitants, is one of Russia's tightly controlled nuclear cities.

A blue sign labeled LNPP-2 points to the left, to a roughly 100-hectare (247-acre) construction site, where the first reactor of the Leningrad 2 nuclear power plant is being built. The reactor will be one of the modern pressurized water reactors, which made a strong impression on Siemens engineers. Even Western experts concede that the VVER-1200, the model being built here, is of the highest quality. The planned double containment shell around the reactor core is supposedly earthquake-proof and strong enough to withstand an airplane crash. As with French producer Areva's competing product, the EPR, if a meltdown occurs, the radioactive material flows into a collecting tank under the reactor pressure vessel to cool down.

NEWSLETTER

The Russians can even passively cool down the reactor core if there is a total power blackout. If that happens, water from pressurized tanks would extinguish the resulting nuclear fire, which reaches temperatures of up to 1,200 degrees Celsius (2,192 degrees Fahrenheit). "Western safety standards are met or even exceeded," says Hannes Wimmer, an expert with the German technical inspection organization TÜV Süd, which tested the reactor model for Siemens.

Kiriyenko's team is not as eager to discuss a group of gray structures standing next to the construction site at Sosnovy Bor, the red-and-white striped chimneys of the Leningrad 1 nuclear power plant. They include four reactors of the same model used at Chernobyl, the RBMK, the oldest of which is 36 years old.

Eleven of these nuclear power plants continue to generate electricity for Russia today. Although their operators insist that all plants have now been upgraded, no amount of modern technology can fully correct the model's basic design flaw: As the temperature rises in the core of the RBMK, so does reactivity. Unless the reactor is cooled, conditions can escalate to the point of meltdown.

Twenty Tons of Plutonium

"These reactors pose a danger for the entire Baltic Sea region," says Oleg Bodrov of the environmental organization Green World. Bodrov, who once worked in the Russia nuclear industry himself, has documented dozens of leaks in the Soznovy Bor nuclear reactors. He believes that an overfilled storage facility for spent fuel rods contains 20 tons of plutonium. The site lies directly in the approach path to the St. Petersburg airport. "If a plane crashes here, it will be a disaster," says Bodrov. And St. Petersburg is downwind from Soznovy Bor.

But Bodrov's warnings always trigger the same reaction. "The plants are declared a state secret, and that's that," says the 57-year-old environmental activist.

This is precisely what could prove to be the biggest obstacle to the German-Russian nuclear pact. Glasnost has remained a foreign word in the industry, in which military and civilian elements remain tightly interwoven. Secrecy and the resulting corruption are widespread.

When Prime Minister Putin met with Kiriyenko and other nuclear industry executives at the Kalinin nuclear power plant in mid-April to discuss the situation, his speech included bitter accusations about "non-purposeful use" of government funds -- a thinly veiled reference to embezzlement and waste.

The location of the nuclear meeting was well chosen. Kalinin is perhaps the most state-of-the-art nuclear power plant in Russia. A tour of the plant's Reactor 3 offers a fascinating look at modern nuclear technology. The reactor's one-gigawatt steam turbine sits in the tower-sized machine building, looking like a fat, yellow bug. A muffled humming sound suggests the forces that are at work here, where the power of the atom is literally palpable. The nuclear fire blazes less than 30 meters (98 feet) away, in a pressure vessel with a diameter of only four meters (13 feet).

In a small chapel on the eighth floor of the administrative building, a statue of St. Nicholas keeps watch over the plant -- apparently with success. "We have had only minor incidents in the last 10 years," says Igor Bogomolov, a senior engineer at the plant. Nevertheless, he does have his worries. "We lack specialists," he says. "The young, qualified people prefer to stay in the cities and work for private companies."

World Class Cadres

Western experts are critical of the Russian nuclear industry's aging workforce and its use of too many poorly trained guest workers. The Russians recognize these problems, and Putin has promised money for a "national nuclear energy university." The aim of the new elite university, which would center around the renowned Moscow Engineering Physics Institute (MEPhI), would be to train "world-class cadres," says Mikhail Strikhanov, rector of the MEPhI.

Under the plan for a national nuclear energy university, Strikhanov would join forces with 23 other institutions, most of them located at nuclear power plant sites. "We must train the students in proximity to the plants; otherwise they will not work there," Strikhanov explains. Salaries are low, he says, and the nuclear sector's image is poor. Nevertheless, Strikhanov is confident that the new university will be capable of training about 2,000 students a year. "However," he adds, "it will be far more difficult to build such a large number of power plants."

He has a point. Insiders report that the Atommash plant in southern Russia, once the country's largest producer of equipment for nuclear power plants, is currently out of commission. The Ishora plant near St. Petersburg is hardly capable of producing more than one reactor a year -- far too little to satisfy Russian ambitions.

Critics also question whether the country can even afford a nuclear renaissance. "A nuclear reactor costs €5 billion ($6.75 billion) today, but Rosatom is calculating with a sum equal to less than half that amount," says Alexander Nikitin of Bellona, a Norwegian environmental organization. "And now the financial crisis has been added to the mix."

Even Vladimir Generalov, director of the government's nuclear power plant development office, Atomenergoprojekt, concedes, "whether entirely new projects will be pushed depends on the worldwide economic situation." According to Generalov, the demand for electricity will decline. "It is hard to say how many reactors will end up going into operation." However, Generalov believes that at least 10 nuclear power plants will be built.

No Permanent Storage Sites

Rosatom has even more worries. For one, the cost of storing about 20,000 tons of spent fuel rods weighs heavily on the budget. There are no permanent storage sites. Instead, Rostatom has a stunning concept on hand for the waste. "Waste? But it isn't waste," says Rostatom spokesman Sergei Novikov. "We leave the material where it is, until it becomes usable in a few decades."

The Russians still dream of a plutonium economy. They are among the last countries worldwide that still operate fast breeder reactors, which produce, at least in theory, more nuclear fuel than they consume. In principle, they could recycle spent fuel rods from conventional reactors.

The world's biggest commercial plant of this type operates in Beloyarsk in the Ural Mountains region, where a second, larger breeder reactor is under construction. But no one is about to win accolades for the plants. Despite decades of research, all attempts to operate breeder reactors at a profit have failed. Besides, the technology is considered to be especially risky.

Another project that has critics up in arms is the construction of floating nuclear power plants. As recently as late April, nuclear energy czar Kiriyenko was strolling cheerfully through the production buildings at the Baltiiski Shipyard in St. Petersburg. At a ceremony there, he pressed a button to launch the construction of a 144 meter (472 foot) long model plant slated for completion in 2011.

Critics also fear that the floating power plants, each equipped with two 35-megawatt reactors, constitute a significant proliferation risk. The specialty reactors burn particularly highly-enriched uranium. "How you do want to prevent terrorists from boarding the ships and simply weighing anchor?" asks Vladimir Kuznezov, a former nuclear inspector and current critic of Rosatom. "We can't even stop Somali pirates."

More Embarrassed than Amused

Given these obstacles, how then can Kiriyenko's team build confidence in Russian nuclear technology among nuclear power plant customers?

Bizarre image campaigns, such as last year's "Miss Atom" contest, are more humorous than effective. In the campaign, attractive female employees at nuclear power plants, the nuclear symbol dangling in front of their beautiful bodies, entered a beauty competition. And when Kiriyenko candidly reported in Kalinin that he taken a dip in the lake into which the plant's cooling water is fed, his audience was more embarrassed than amused.

Only transparency and reliability can make Russia a full-fledged partner of Siemens. In the past, too many plans never made it off the drawing board. In 1992, for example, the Russians planned to build 26 domestic reactors. A grand total of three have been completed since then.

The Russians also have some catching up to do when it comes to technology. Kiriyenko's nuclear power plant salesmen are proud to take new customers on tours of a Russian-built nuclear power plant in the Chinese city of Tianwan. However, the plant's operators complain that it can only be run at full capacity just over 80 percent of the time. This complaint was probably one of the reasons a contract to build another nuclear power plant in the coastal Zhejiang Province was awarded to a competitor, US nuclear power plant producer Westinghouse.

Nevertheless, optimism still prevails at Siemens headquarters. The Russian government plans to subsidize the nuclear industry with about €15 billion ($20 billion) by 2015. In the event of a joint venture, the money would also benefit the Germans. Besides, public criticism is hardly to be expected in Russia, where there is no anti-nuclear movement. And the press has been more or less forced to toe the pro-nuclear line.

The Siemens executives even choose to ignore an image problem of Russian technology. "I have no doubt that Russia will satisfy our quality standards," says Wolfgang Dehen, the head of the energy sector at Siemens. "Chernobyl, after all, is more than 20 years in the past."

By Philip Bethge, Dinah Deckstein, Wladimir Pyljow and Matthias Schepp

Translated from the German by Christopher Sultan